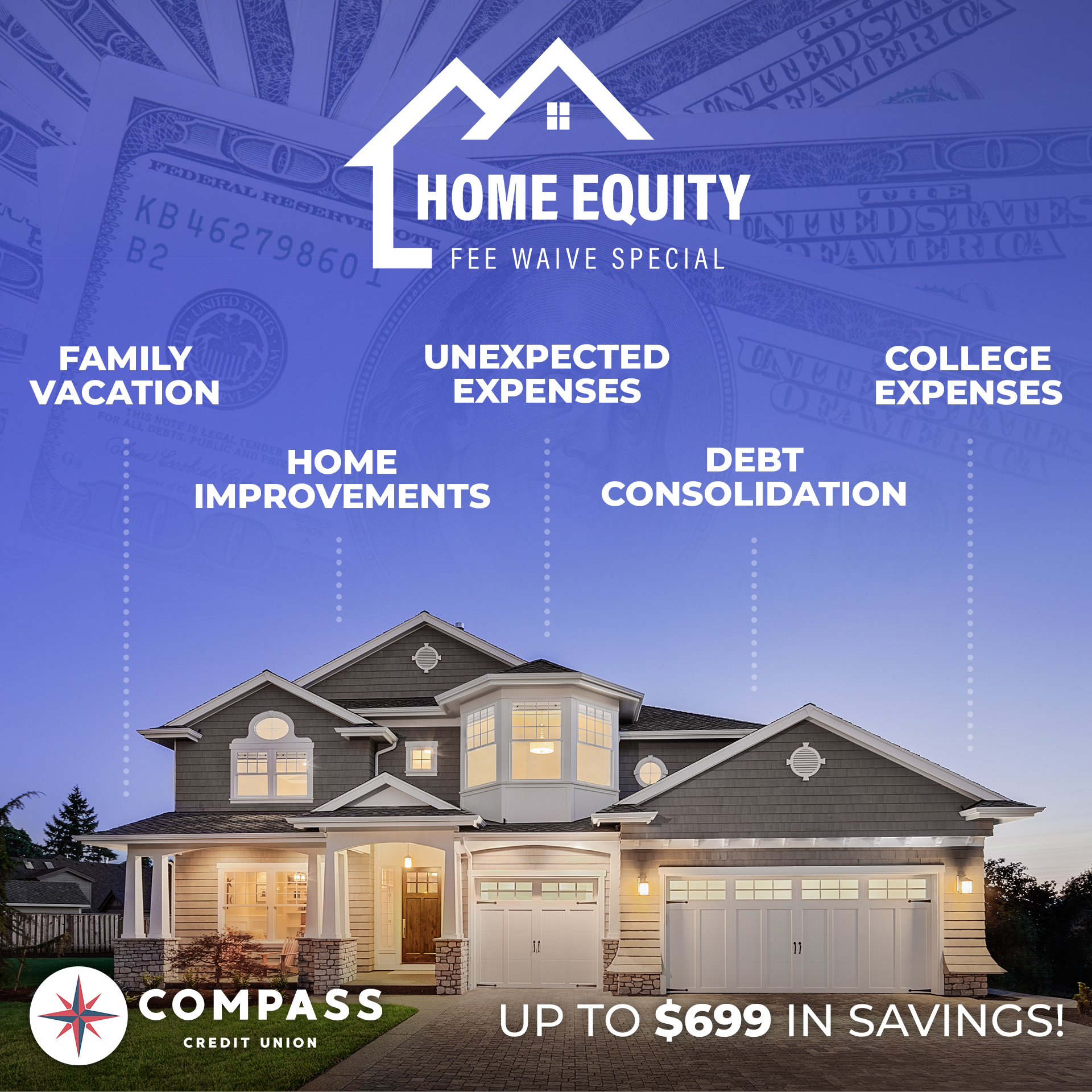

HOME EQUITY FEE WAIVE SPECIAL

Thinking about home improvements, consolidating debt, or putting your money to work in a smarter way?

If rising costs and life’s responsibilities are stretching your budget thin, a home equity loan could be your financial reset.

- Up to $699 in fee savings*

- Low interest, high flexibility

- Fast approvals

- Use your equity your way

Right now, we’re waiving fees. Most lenders charge you just to access your home’s value, but we believe you shouldn’t pay to use what’s already yours.

Unlock Your Home’s Value

Fast Approvals

Up to $699 in Savings

Use Your Equity Your Way

MEMBER REVIEWS

Cash Out Confidently

Questions? We Can Help!

Anything – home improvements, debt consolidation, college tuition, even a wedding. It’s your money – we’re here to make it work for you.

Typically up to 80% of your home’s value minus what you owe. We’ll walk you through it.

We’re waiving all closing costs. That’s money most lenders charge upfront – and we’re covering it.

We offer both fixed-rate home equity loans and variable-rate lines of credit. We’ll help you pick the one that fits best.

Home equity is the difference between your home’s current market value and the amount you still owe on your mortgage.

Home Equity = Current Market Value of Home – Mortgage Balance

*All Compass Credit Union loan promotions, rates, terms, and conditions are subject to change at any time without notice. Mortgage, Auto, Recreational/ Farm Equipment, Unsecured, Credit Cards, and current Compass Credit Union loans, are not eligible for this promotion. A+ through C credit scores. Offer good while supplies last. Offer subject to credit approval.