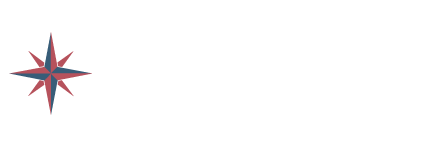

Get Paid Early

PAYROLL, DIRECT DEPOSIT, & TAXES

Set up a direct deposit to your Compass Credit Union account and you can receive your deposit up to two days earlier. That means less time waiting for your money and no paper checks to get lost in the mail. When the deposit shows pending you can choose the option to post the deposit to your account early, for a small processing fee.

Get Paid Early

PAYROLL, DIRECT DEPOSIT, & TAXES

Set up a direct deposit to your Compass Credit Union account and you can receive your deposit up to two days earlier. That means less time waiting for your money and no paper checks to get lost in the mail. When the deposit shows pending you can choose the option to post the deposit to your account early, for a small processing fee.

Debit Card Round Up

Automatic savings

Every time you make a purchase using your debit card, the transaction is rounded up to the nearest dollar, and the increased amount is then transferred to your selected savings account. The round up process is not posted immediately, on a per- transaction basis. Instead, a single transfer is made from the checking account to the savings account for that day’s total.

Example: See the picture to the left of purchases that were posted to the account. At the end of the day, the total of the round up transfer would be $1.58.

Debit Card Round Up

AUTOMATIC SAVINGS

Every time you make a purchase using your debit card, the transaction is rounded up to the nearest dollar, and the increased amount is then transferred to your selected savings account. The round up process is not posted immediately, on a per- transaction basis. Instead, a single transfer is made from the checking account to the savings account for that day’s total.

Example: See the picture to the left of purchases that were posted to the account. At the end of the day, the total of the round up transfer would be $1.58.

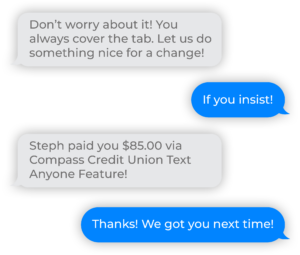

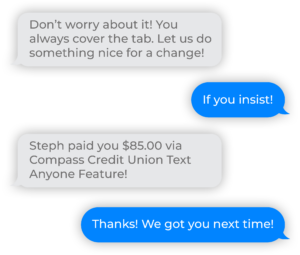

Text & Pay Anyone

Secure & Easy

Pay friends, split the tab, or send someone a little extra birthday money. You can quickly, securely, and easily send money to anyone, anywhere with the Pay Anyone feature. Once the recipient accepts the transaction and provides their valid account number, funds will be deposited into their account within one to two business days. *

*Not available to business online banking members.

Text & Pay Anyone

Pay Anyone

Pay friends, split the tab, or send someone a little extra birthday money. You can quickly, securely, and easily send money to anyone, anywhere with the Pay Anyone feature. Once the recipient accepts the transaction and provides their valid account number, funds will be deposited into their account within one to two business days. *

*Not available to business online banking members

Security & Control

Mobile App Card Management

- Instantly turn your debit and credit card(s) on and off

- Set up notifications for activity and spending

- Monitor card activity

- Report card lost or stolen

- Submit travel notifications

Security & Control

Mobile App Card Management

- Instantly turn your debit and credit card(s) on and off

- Set up notifications for activity and spending

- Monitor card activity

- Report card lost or stolen

- Submit travel notifications

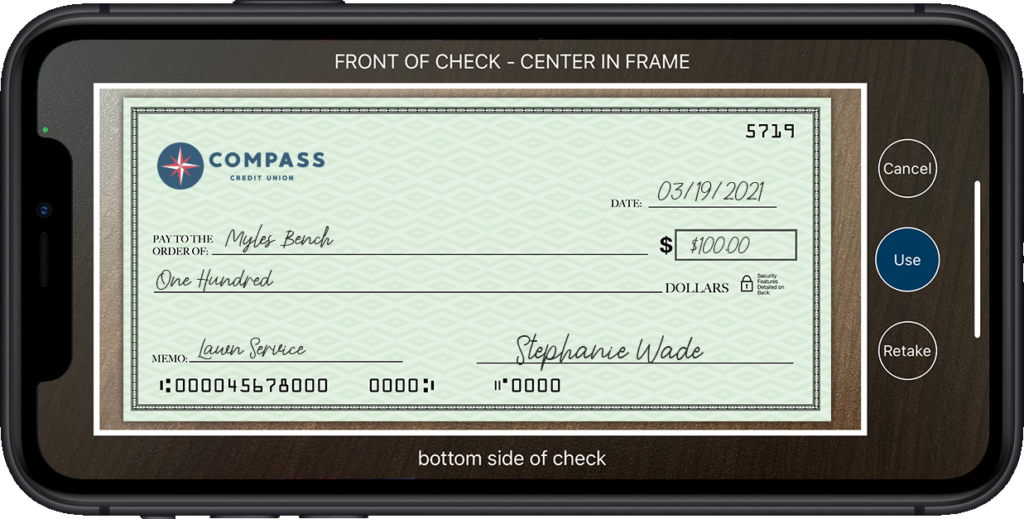

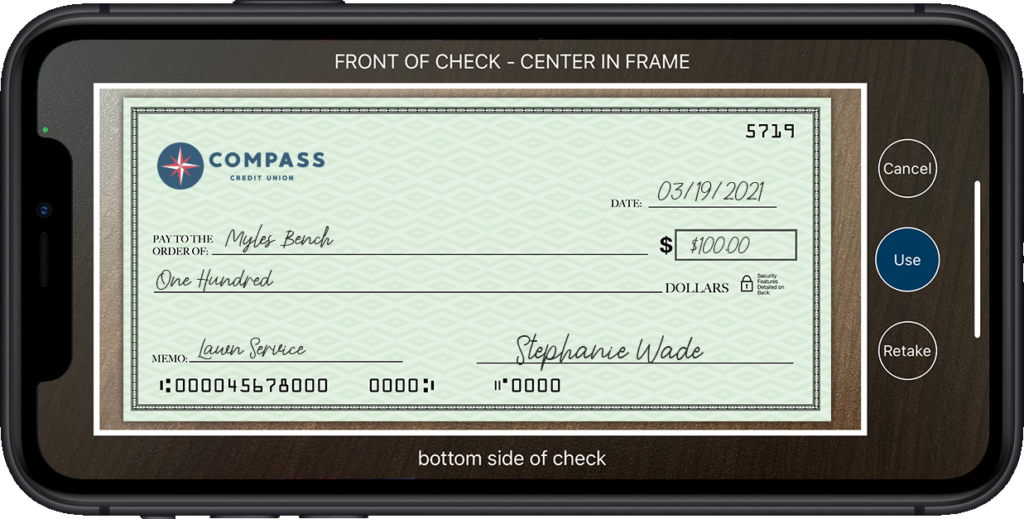

Remote Deposit Capture

Deposit checks on the go

Deposit your checks anytime, anywhere using the Compass CU mobile app. This free service makes it easier than ever to bank with CCU. To ensure efficient use of RDC, please include your signature and the required restrictive endorsement “For Mobile Deposit Only to Compass Credit Union” on the back of the check.

Remote Deposit Capture

Deposit checks on the go

Deposit your checks anytime, anywhere using the Compass CU mobile app. This free service makes it easier than ever to bank with CCU. To ensure efficient use of RDC, please include your signature and the required restrictive endorsement “For Mobile Deposit Only to Compass Credit Union” on the back of the check.

Automated Fraud Alerts

Protect your account via text

Automated Fraud Alerts provide you with valuable knowledge about potential fraud situations while you’re on the go. You can act the second you receive the text message alert – by responding to the message and confirming the transactions as valid or fraudulent. *

If you identify the suspect activity as valid, the automated response will immediately unblock the card for use so you can carry on with the rest of your shopping. If you identify the suspect activity as fraud, the card replacement process can be initiated immediately.

*We will never ask for debit/credit card number, social security number, account number, or any other personal identifying information.

Automated Fraud Alerts

Protect your account via text

Automated Fraud Alerts provide you with valuable knowledge about potential fraud situations while you’re on the go. You can act the second you receive the text message alert – by responding to the message and confirming the transactions as valid or fraudulent. *

If you identify the suspect activity as valid, the automated response will immediately unblock the card for use so you can carry on with the rest of your shopping. If you identify the suspect activity as fraud, the card replacement process can be initiated immediately.

*We will never ask for debit/credit card number, social security number, account number, or any other personal identifying information

CCU Personal Banking App

With our online features you will be able to do banking whenever-wherever. Get started today:

CCU Business Banking App

With our online features you will be able to do banking whenever-wherever. Get started today: